Abstract:

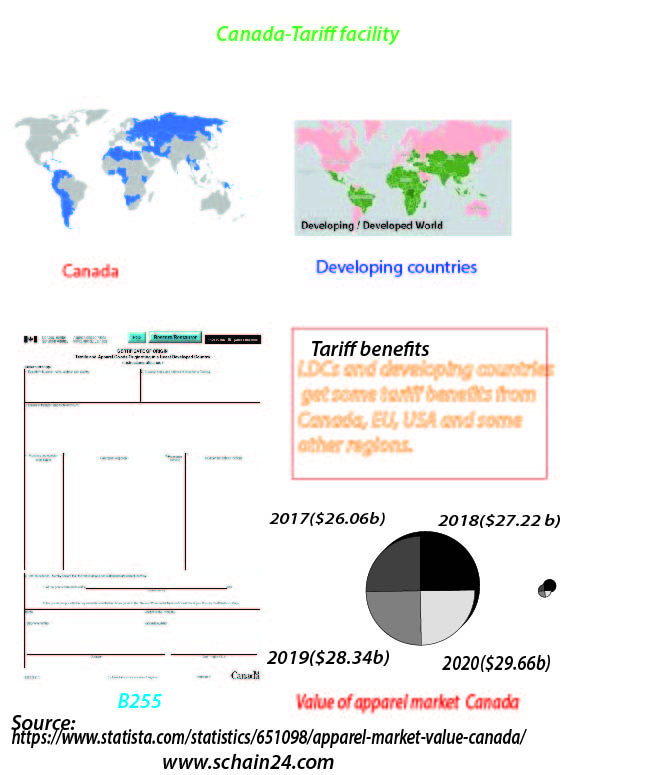

Based on rules of origin LDC Tariff facility, either must be fully produced at a LDC country or cumulative value addition by other LDC or Canada. Canada has offered Bangladesh a wider package support for maximize trade opportunities out of the already-granted free market access to the North American country. It is required that to be eligible to issue B255 and be eligible for benefits of Market Access Initiative must sign a Memorandum of understanding with the Canada government ,so that CCRA can audit and investigate the shipments claiming eligibility under this Market Access Initiative. Canada’s Foreign Affrairs and International Trade has a list of signatories in the below website: of all tariff categories mentioned in the below mentioned Canada Government website: The CCRA may check the thorough bill of lading showing the goods shipped directly to the consignee in Canada.Currently, Bangladesh is enjoying tariff-free market access for 90 per cent to 100 per cent products in all the developed countries except the United States. Tariff-free and low-tariff market access facilities in the developed and some developing countries immensely benefited Bangladesh. Bangladesh High Commissioner to Ottawa Kamrul Ahsan in a recent letter wrote to the Ministry of Commerce that Bangladesh has been confirmed as a priority country for a five-year trade-facilitation program. The envoy also wrote that the government of Canada has already confirmed Bangladesh’s continuation of enjoying general preferential tariff (GPT) for the priod from January 2014 to December 2023.

Keywords: LDC, Developing countries, Bangladesh, Canada, Tariff etc.

Introduction:

LDCs and developing countries get some tariff benefits from Canada, EU, USA and some other regions. So that they can improve their capacity to enter in Canada and other countries with their products. But they need to follow some rules of origin and requirements to get those benefit. Some countries like Bangladesh are being graduated by international organizations from LDCs to developing countries. Bangladesh will be formally graduated to developing country by 2023. Till that time it would get the benefits that she is getting as an LDC. In this article we will take the opportunity to analyze developing countries export facilities to Canada.

Package support from Canada:

Canada has offered Bangladesh a wider package support for maximize trade opportunities out of the already-granted free market access to the North American country. The Trade Facilitation Office (TFO) of Canada in a recent letter informed the Bangladesh High Commission in Ottawa about developments. Official sources said the market-access facility to Bangladesh has been further extended by including more features in the trade-support program to help augment the volume of its export to Canada.

Bangladesh export to Canada:

Bangladesh High Commissioner to Ottawa Kamrul Ahsan in a recent letter wrote to the Ministry of Commerce that Bangladesh has been confirmed as a priority country for a five-year trade-facilitation program. Bangladesh High Commissioner to Ottawa wrote that quality of Bangladesh’s apparel products as well as efficient supply-chain mechanism has largely contributed to doubling bilateral trade in a decade. Bangladesh is the second-largest source country of Canadian imports from South Asia after India. Bangladesh mainly exports knitwear, woven, textile articles, headgear, fish and seafood, and footwear to Canada. Garments and textile products accounted for over 90 percent of Canada’s merchandise imports from Bangladesh. The envoy also wrote that the government of Canada has already confirmed Bangladesh’s continuation of enjoying general preferential tariff (GPT) for the period from January 2014 to December 2023.

Developing countries:

The Developing countries list include the following countries are included: Afghanistan,Albania,Algeria,American Samoa,Angola,Anguila,Antigua and Barbuda,Argentina,Armenia,Azerbaijan,Bahrain,Bangladesh,Barbados,Belarus,Belize,Benin,Bhutan,Bolivia,Bosnia/Herzegovina,Botswana,Brazil,British Virgin Islands,Bulgaria,Burkina Faso,Burundi,Cambodia,Cameroon,Cape Verde,Central African Rep.,Chad,Chile,China,Colombia,Comoros,Congo Dem. Rep.,Congo, Rep.,Cook Islands,Costa Rica,Cote d’Ivoire,Croatia,Cuba,Czech Rep.,Djibouti,Dominica,Dominican Rep.,Ecuador,Egypt,El Salvador,Equitorial Guinea,Eritrea,Estonia,Ethiopia,Fiji,Gabon,Gambia,Georgia,Ghana,Grenada,Guadeloupe,Guatemala,Guinea,Guinea-Bisseau,Guyana,Haiti,Honduras,Hungary,India,Indonesia,Iran,Iraq,Isle of Man,Jamaica,Jordan,Kazakhstan,Kenya,Kiribati,Korea, Dem. Rep.,Korea, Rep.,Kyrgyz Rep.,Laos,Latvia,Lebanon,Lesotho,Liberia,Libya,Lithuania,Macedonia,Madagascar,Malawi,Malaysia,Maldives,Mali,Malta,Marshall Islands,Martinique,Mauritania,Mauritius,Mayotte,Mexico,Micronesia Fed.Moldova,Mongolia,Montserrat,Morocco,Mozambique,Myanmar,Namibia,Nepal,Netherlands Antilles,Nicaragua,Niger,Nigeria,Oman,Pakistan,Palau,Panama,Papua New Guinea,Paraguay,Peru,Philippines,Poland,Puerto Rico,Romania,Russian Fed.Rwanda,Samoa,Sao Tome and Principe,Saudi Arabia,Senegal,Seychelles,Sierra Leone,Slovak Rep.,Slovenia,Solomon Islands,Somalia,South Africa,Sri Lanka,St. Kitts and Nevis,St. Lucia,St. Vincent and Grenadines,Sudan,Suriname,Swaziland,Syria,Tajikistan,Tanzania,Thailand,Togo,Tonga,Trinidad and Tobago,Tunisia,Turkey,Turkmenistan,Tuvalu,Uganda,Ukraine,Uruguay,Uzbekistan,Vanuatu,Venezuela,Vietnam,West Bank and Gaza,Yemen,Yugoslavia, Fed. Rep.,Zambia,Zimbabwe.

Trade benefits:

Currently, Bangladesh is enjoying tariff-free market access for 90 per cent to 100 per cent products in all the developed countries except the United States. Tariff-free and low-tariff market access facilities in the developed and some developing countries immensely benefited Bangladesh. Some developing countries like China and India also allowed tariff-free market access to various products. Multilateral trade regime within the framework of the World Trade Organization (WTO) allows LDCs to get tariff-free market access. For instance, having only 25 per cent local value addition, any Bangladeshi products except dairy, eggs and poultry can enter into Canadian market without any duty. This is to say, the country will enjoy the existing market access benefits till 2027. The trade-related benefits including market access facilities will, however, continue for another three years.[1]

Rules of Origin:

Based on rules of origin, Tariff treatments are under three different tariff codes: LDC 08; GPT 09; MFN 02 according to CCRA internet site:

http://www.ccra.gc.ca/E/pub/cm/d17-1-10/README.html.

For duty free export to Canada eligible for LDC Tariff facility, either must be fully produced at a LDC country or cumulative value addition by other LDC or Canada. To be considered for LDC cumulative, parts or production of goods is no more than 60% of the ex-factory price. Certificate of Origin (B255) is required for goods originating in LDC which are under HS 50-63,which includes textile and apparel goods originating in LDCs. A link for B255 given below:

It is required that to be eligible to issue B255 and be eligible for benefits of Market Access Initiative must sign a Memorandum of understanding with the Canada government ,so that CCRA can audit and investigate the shipments claiming eligibility under this Market Access Initiative. Canada’s Foreign Affrairs and International Trade has a list of signatories in the below website:

http://www.dfait-maeci.gc.ca/tna-nac/DS/mou-en.asp.

Information of all tariff categories mentioned in the below mentioned Canada Government website:

http://www.cbsa-asfc.gc.ca/trade-commerce/tariff-tarif/2013/html/countries-pays-eng.html